28+ fha loan mortgage insurance

It usually remains for the life of the loan. Web The plan will cut mortgage insurance costs by 30 for buyers who take out Federal Housing Administration-backed mortgage loans from 085 to 055.

When And How To Cancel Fha Monthly Mortgage Insurance Mip

Web The upfront mortgage insurance premium is 175 of the loan amount or 1750 for every 100000 borrowed.

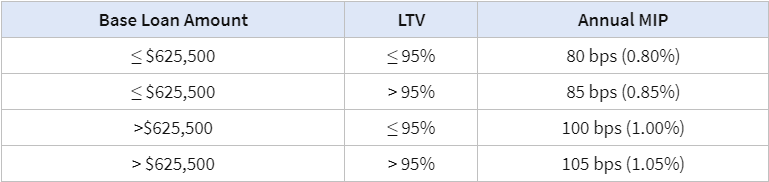

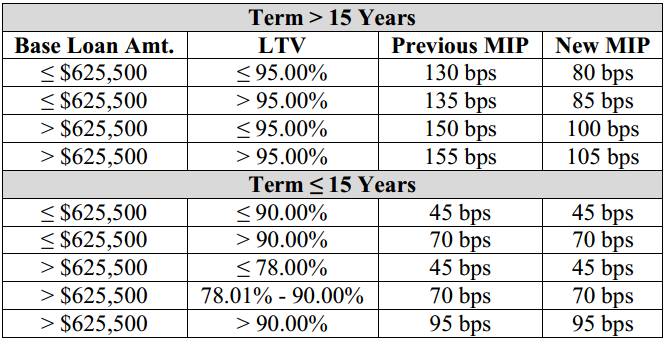

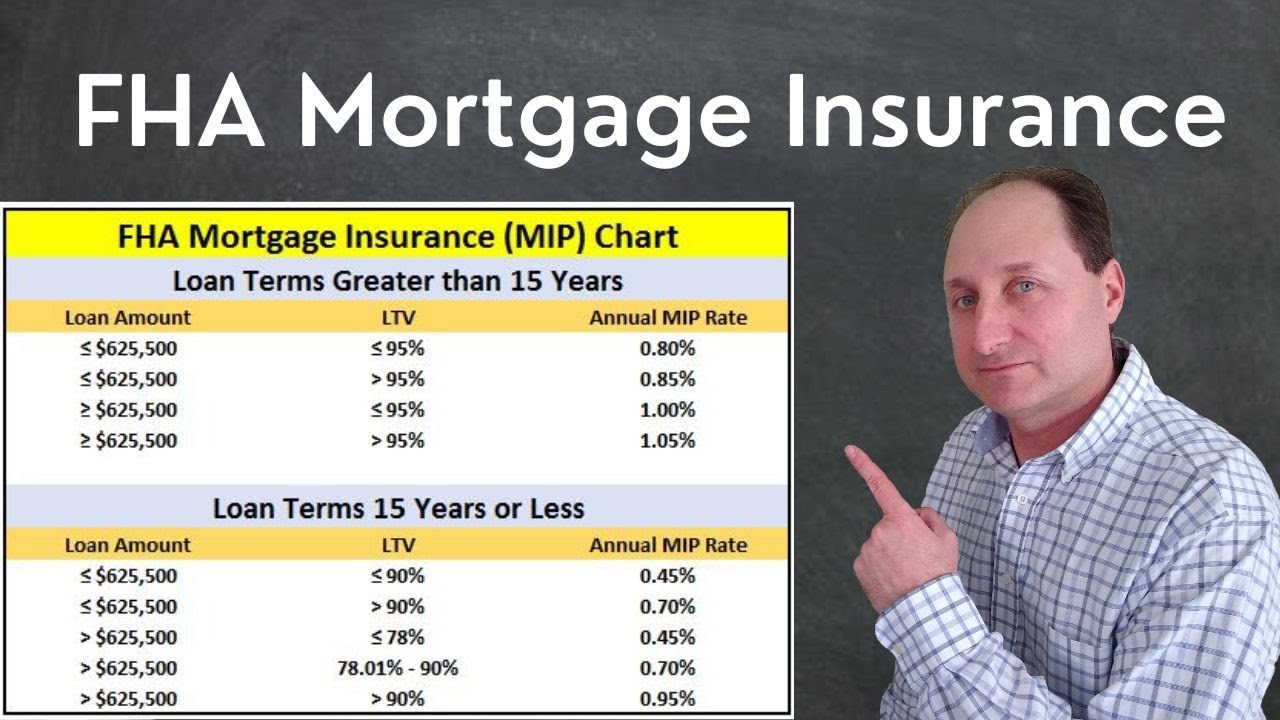

. Web FHA mortgage insurance varies from 045 to 105 of the loan amount. The upfront mortgage insurance. Here are some of the big takeaways from the change.

Learn how the FHA mortgage insurance reduction makes financing more affordable. Web In this case your annual FHA loan mortgage insurance would cost you 080 of your loan amount which is 2000 total in the first year of your mortgage. All FHA loans require mortgage insurance.

Web After the reduction announced today most borrowers will pay 50 bps or 05 of the loan amount as the FHA annual mortgage insurance premium. Web What it means for you. Web Appendix 10 Mortgage Insurance Premiums 03202023 Upfront Mortgage Insurance Premium UFMIP All Mortgages.

Web FHA mortgage insurance includes both an upfront cost paid as part of your closing costs and a monthly cost included in your monthly payment. Web When you take out an FHA loan your lender will collect a one-time upfront mortgage insurance premium thats equal to 175 of the loan amount. The amount youll pay depends on the size of your loan and your down payment.

In our latest video we break down what it is how long youll pay it and ho. Streamline Refinance and Simple Refinance Mortgages used to refinance a previous FHA-endorsed Mortgage on or before May 31 2009. However there are a few ways to potentially avoid or reduce FHA MIP.

The larger your down payment the less youll. Web FHA mortgages just got a price cut. The program extends mortgage insurance to FHA loans for one- to four-unit condominiums houses and manufactured homes.

Those factors also determine how long youll owe MIP. They are popular especially among first time home buyers because they allow down payments of 35 for credit scores of 580. In our example your payments will be about 167 a month.

Web Are you puzzled about Mortgage Insurance Premiums on FHA loans. For borrowers who closed on or after June 3 2013 your MIP should end after 11 years if you made a down payment of more than 10. Streamline refinances and some simple refinances 001 UFMIP Hawaiian home lands 2344 to 380 UFMIP depending on the loan term Indian.

FHA loan MIP can be rolled into the mortgage meaning your monthly mortgage payment will also include the fee. Web Earlier this morning HUD released details of a long-anticipated plan to reduce the annual MIP mortgage insurance premiums that are currently charged to FHA borrowers by 30 Basis Points. Web On a 101750 30-year fixed-rate FHA loan at 4 percent your monthly mortgage payment excluding homeowners insurance and property taxes would be 485 compared to 477 without financing.

Web How much is FHA mortgage insurance. The 175 UFMIP applies to most FHA loans no matter the loan amount or term except for the following. Web FHA mortgage insurance is government-backed insurance that protects the lender if the borrower defaults on a mortgage.

FHA requires both upfront and annual mortgage insurance for all borrowers regardless of. By NerdWallet Updated Nov 28 2022 Edited. Say no more.

The reduction could save 850000. Mortgage insurance is a policy that protects lenders against losses that result from defaults on home mortgages. Web Mortgage Insurance MIP for FHA Insured Loan.

Most FHA borrowers put down less than 10 and will pay annual MIP between 080 and. Web There are two components to FHA mortgage insurance. First theres an upfront mortgage insurance premium of 175 of the total loan amount.

The mortgage insurance premium MIP on FHA loans will be reduced by 030 percentage points from 085 to 055 of the loan amount. This is a cost that you will pay in installments each month as part of your monthly mortgage bill. So if you borrowed 150000 youd be required to.

Web FHA Mortgage Insurance Cancellation If your mortgage started between January 2001 and June 3 2013 your MIP should automatically cancel once you reach 22 in home equity. Web FHA mortgage borrowers will pay 175 of their loan amount in upfront mortgage insurance costs and they typically also pay an 085 annual premium which is added to their monthly. 175 Basis Points bps 175 of the Base Loan Amount.

If you dont have enough cash on hand to pay the upfront fee you are allowed to roll the fee into your mortgage instead of paying it out of pocket. Be cautious though as MIP isnt the only premium youll pay with an FHA home loan. The MIP is dependent on the loan term higher for a 30-year loan than a 15-year loan down payment lower for 10 down payment and loan amount higher for loan amounts greater than 726200.

The annual premium rate is based on your loan amount and down payment. Conventional loan insurance is a private insurance policy that helps protect lenders from losses if. Web For an area to be eligible for FHA-insured mortgage loans under the Section 238c program the Secretary of Defense must have certified that there is a need for additional housing in the area and are no plans to close or relocate the military base for five years following the certification.

MIP is a required fee that is designed to protect mortgage lenders in case a borrower falls behind or defaults on the home loan. Web An FHA loan is a mortgage thats insured by the Federal Housing Administration FHA. Web FHA mortgage insurance is a government-sponsored program that helps protect lenders from losses if a borrower defaults on their mortgage.

However borrowers must pay mortgage insurance premiums which protects the lender if a borrower defaults. Web When you take out an FHA loan you must pay an upfront mortgage insurance premium at the time of closing plus an annual mortgage insurance premium which would be divided into 12 monthly payments. Web The Biden Administration has announced that it will cut mortgage insurance premium fees by 030 of a percentage pointfrom 085 to 055for mortgages backed by the Federal Housing.

Make a larger down payment If you can afford to make a larger down payment you can reduce the amount of your FHA loan and potentially reduce your MIP payments. Web FHA mortgage insurance MIP is required on all FHA loans regardless of the down payment amount. 41552 1C12c Section 238c Application Eligibility.

Fha Mortgage Insurance What You Need To Know Nerdwallet

Antonia Barry Realtor Annapolis Md

Fha To Reduce Monthly Mortgage Insurance Fha Mortgage Source

Fha Announces Lower Mortgage Insurance Premiums

Biden Still Likely To Cut Fha Premiums In The Future Analysts Say National Mortgage News

Lower Fha Mortgage Insurance Premiums Set To Take Effect In March

April 2012 The New Fha Mortgage Insurance Premiums Mip Schedule

Fha Loan Guarantee Fee Explained Fha Mortgage Source

Theresa J Piper Team Captain Go Mortgage Linkedin

Fha Mortgage Insurance For 2023 Estimate And Chart Fha Lenders

Fha Requirements Mortgage Insurance For 2023

Fha Loans Just Got Cheaper Thanks To Hud S Mortgage Insurance Cut

Home Mortgage Loan Lowest Rates Lowest Fees Lowest Costs No Closing Cost No Points Fast Closings Denver Colorado Experienced

Fha Mortgage Insurance For 2023 Estimate And Chart Fha Lenders

What Is An Fha Mortgage Insurance Premium Cinch Home Loans

Compass Clock Fall Winter 2018 Publication

What Is Fha Mortgage Insurance Rocket Mortgage